Any income that is accrued in Singapore by a person or business is subject to income tax. This means that if a customer pays you for your product & services in Singapore, or if you receive money in Singapore from your overseas sales, the money is subject to tax. Taxable income includes income from your business, salary from employment, interest earned on your deposits and rental income.

Foreigners Working in Singapore

Foreign employees working in Singapore either on work permit or employment pass will be taxed as above in Singapore unless:

The person is on short-term employment no exceeding 60 days in a calendar year

his/her earnings are exempt from tax under the Avoidance of Double Taxation Agreement

As a tax resident, you will be taxed on all personal income derived in Singapore.

When a foreign employee stops his term of employment in Singapore, his employer is required to inform IRAS before the termination of employment or departure from Singapore. The employer shall also withhold whatever money due to the employee until tax clearance is given.

Central Provident Fund (CPF)

Foreigners on work pass are exempt from CPF contributions in Singapore.

Capital Gains Tax

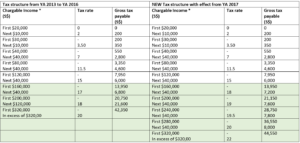

Capital gains or investment income is not subject to tax. For example, if you buy and sell shares at a profit in Singapore, the profit is not subject to tax. However, the dividends that you earn from the shares is considered an income and thus subject to tax. If you are a tax resident, your total income less deductions (expenses, donations and tax reliefs) will be subject to tax at progressive rates ranging from 0% to 20%. For tax residents, you may use this tax calculator to estimate your tax payable.

Income Tax Returns Filing Deadline

It is required that all completed income tax returns forms must be submitted to the Singapore Tax Department by the 15th of April each year. You do not necessarily have to file your income tax if your annual income is less than S$ 22,000, unless you have been specifically instructed by the Singapore tax department to submit your tax return.

Our Personal Income Tax Service Fee

| Service | Fee ($) |

|---|---|

| Personal Tax Computation and Filing | 100 – 250 |

| Preparation of IR8A | 100 |

| Tax Clearance for Expatriates | 300 – 500 |